The buzz around same-day-delivery has increased lately, fuelled by the entrance of Amazon, eBay and Wal-Mart into this market segment. Now Google reportedly is throwing down its gauntlet too!

Amazon push in this space shouldn’t come as a surprise. Convenience and instant gratification of immediately delivery will pull consumers into its online ecosystem away from brick-and-mortar stores.

The years Amazon has spent to streamline its business model to be run with razor-thin margins will enable it to absorb the cost for same-day or free delivery in order to gain market share.

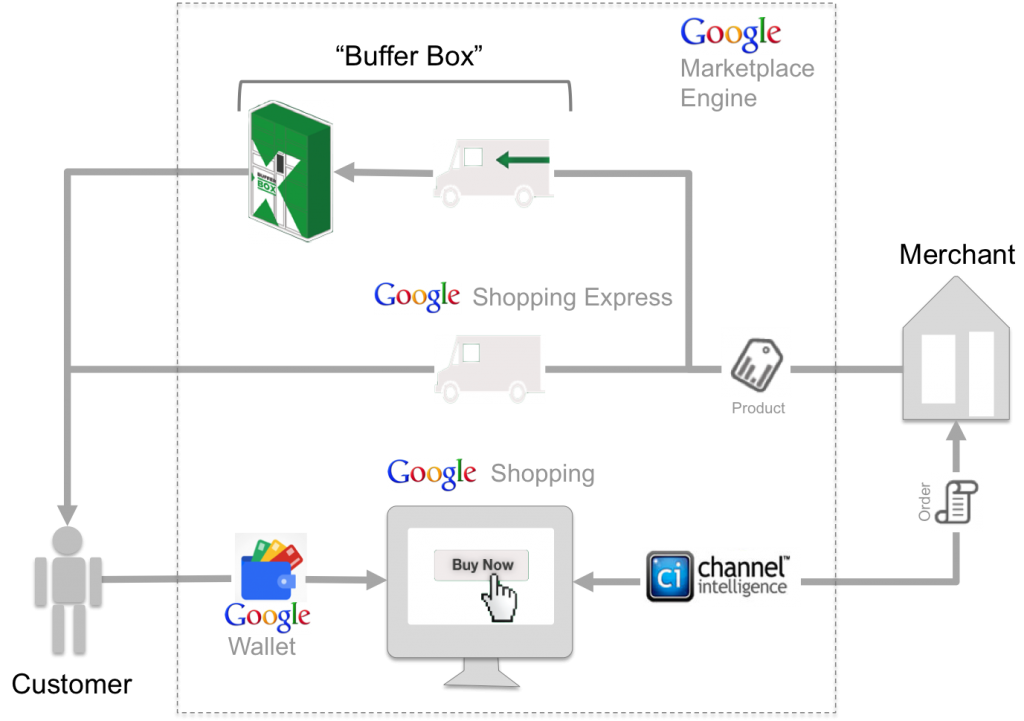

Google, jumping into the delivery business by acquiring BufferBox to compete with Amazon Locker and reportedly building Google Shopping Express, needs context to be understood.

Google recently has revamped the experience (e.g. support of “nearby stores”) and the business model (to paid-inclusion) of its shopping vertical. It also has acquired Channel Intelligence a commerce enabler that offers feed generation, optimization, reporting and consulting.

Obviously Google is in the process of assembling a new marketplace engine to better competing with Amazon and the like:

Google uses its Product Search (aka Froogle) shopping comparison engine ecosystem to start the transformation. By changing the catalog to paid-inclusion it gains a direct merchant relationship removing free riders.

The fact that Google in that process doesn’t mind loosing Amazon as customer – a significant hit in product selection – should become understandable now.

Merchant benefit from Google’s offering, if it helps them to compete with Amazon, especially if Google initially subsidizes shipping, which is reasonable to assume.

The new Product Listing Ads that have been introduced by Google are attractive to merchants since they provide a greater control over sales – the higher a product is bid up in results the more traffic it sees.

A strategy as outlined above hits all the checkboxes for success: its starts with an existing ecosystem, it rewards early movers, and it has the chance to pull-in customers and merchants a like through network effects. It would create an attractive offering of local products and merchants.

What needs to be seen is, if it can reach economy of scale quickly enough to fend off Amazon.

The benefits of Google revitalizing its commerce marketplace should be obvious. In addition Google will gain deeper insight into the purchase process and history of customers.

Behavioral data acquired in such a way will help to improve ad targeting in its network and allows to better compete with Amazon’s and Facebook’s entrance into the market of ad exchanges.